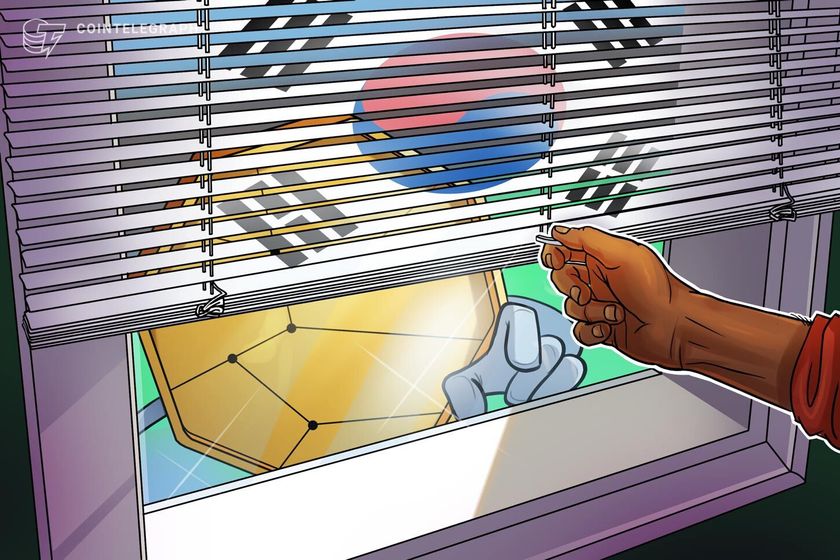

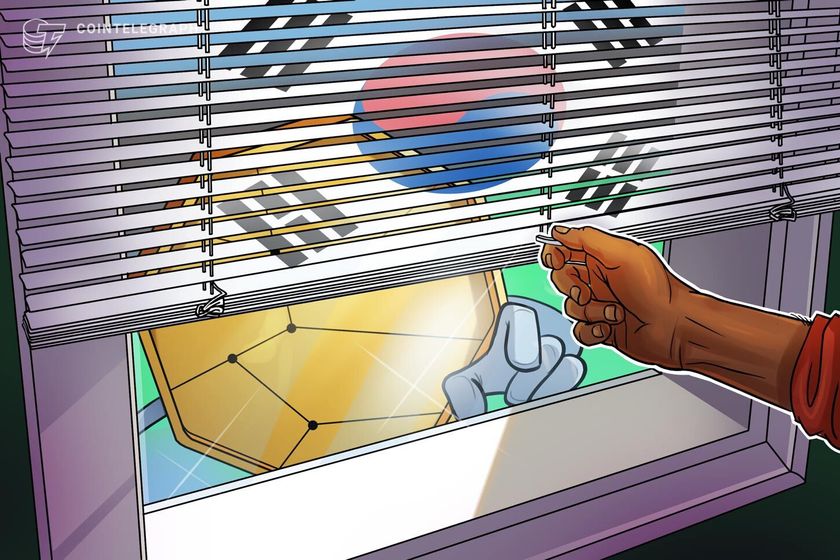

South Korea is expanding a ban on digital asset firms’ applications servicing its citizens. On April 11, the country’s Financial Services Commission (FSC) announced that 14 crypto exchanges were blocked on the Apple store. Among the affected exchanges are KuCoin and MEXC.

The report, which was made public on April 14, says the banned exchanges were allegedly operating as unregistered overseas virtual asset operators. The report also states that the Financial Information Analysis Institution (FIU) will continue to promote the blocking of the apps and internet sites of such operators to prevent money laundering and user damage.

The request to block applications on the Apple Store comes after Google Play blocked access to several unregistered exchanges on March 26. KuCoin and MEXC were also targeted during the blocking of the Google Play apps. The FSC published a list of 22 unregistered platforms operating in the country, with 17 of them already blocked on Google’s marketplace.

The 17 crypto exchanges blocked on Google Play. Source: FSC

According to the FSC report, users will not be able to download the apps on the Apple Store, while existing users will not be able to update the apps. The FSC notes that “unreported business activities are criminal punishment matters” with penalties of up to five years in prison and a fine of up to 50 million won ($35,200).

FIU considers sanctions against unregistered VASPs

On March 21, South Korean publication Hankyung reported that the FIU and the FSC were considering sanctions against crypto exchanges operating in the country without registration with local regulators. The sanctions included blocking access to the companies’ apps.

In South Korea, operators of crypto sales, brokerage, management, and storage must report to the FIU. Failure to comply with registration and reports is subject to penalties and sanctions.

Related: South Korea reports first crypto ‘pump and dump’ case under new law

The latest sanctions come as crypto is reaching a “saturation point” in South Korea. As of March 31, crypto exchange users in the country passed 16 million — equivalent to over 30% of the population. Industry officials predict that the number could surpass 20 million by the end of 2025.

Over 20% of South Korean public officials hold cryptocurrencies, with the total amount reaching $9.8 million on March 27. The assets varied and included Bitcoin (BTC), Ether (ETH), XRP (XRP), and Dogecoin (DOGE).

Magazine: Asia Express: Low users, sex predators kill Korean metaverses, 3AC sues Terra